6 ways to avoid unhinged holiday spending

Plus more of my tips for not blowing all your cash on expensive gifts and things you don't need this holiday season

Content entrepreneur | Agency Founder & CEO | Bestselling author Featured in Forbes, The Wall Street Journal, Business Insider, Bankrate, Cheddar TV, and HuffPost | Join more than 6,480 people on the internet who follow me for my lifestyle, travel, and money content. It’s free to subscribe or you can also pledge support for a paid subscription:

‘Tis the season—when everything you wanted, but were too coquettish to buy at full price, goes on sale, sale, SALE! at ridiculously low, low prices.

For me, it’s a new set of premium stainless steel cooking pans.

I’ve known that non-stick pans leak toxins, especially when they get scratched up.

After reading more articles to freak myself out about this, and seeing more scratches on my 3-year-old used and abused nonstick ScanPans, I’ve finally decided to replace them with steel ones.

I’m justifying this purchase as an investment and a benefit for my long-term health.

But also, the new pans are downright beautiful and will really elevate my cooking experience.

For everything else, I’m deliberately turning a blind eye.

Because I know too well, things can get out of hand when one is bombarded with and succumbs to emails and texts from favorite but also randomly-shopped retailers, touting “limited time” deals that can only be redeemed from within hours to by next Monday.

It can be tempting to buy all the stuff.

But you’re strong. And just because it’s on sale doesn’t mean you need it. Read that again.

I understand it’s the holidays and you may need gifts for others.

A reminder that meaningful books, beautiful journals and stationary, and nice writing pens (these and these are some faves; the latter I found on an Asiana Airlines biz class flight and tracked them down) make for the best inexpensive presents.

Other low-cost gift ideas include these under $25 lists by the New York Times and Esquire.

For everything else, if you are struggling to pay off your credit card bills in full each month with enough money left over to save, invest, or spend on your needs, then please reconsider before hitting that buy button.

Or worse, putting it on modern layaway plans offered by Afterpay or Klarna.

If you don’t need it as a gift or for yourself, then exercise restraint.

Credit card debt isn't sexy, and it's on the rise. And it’s possibly keeping you from being able to invest in other bigger life goals like education, property, family planning, or even a new business.

I'm not nagging you about being naughty with your plastic, but let me just regale you with a personal story.

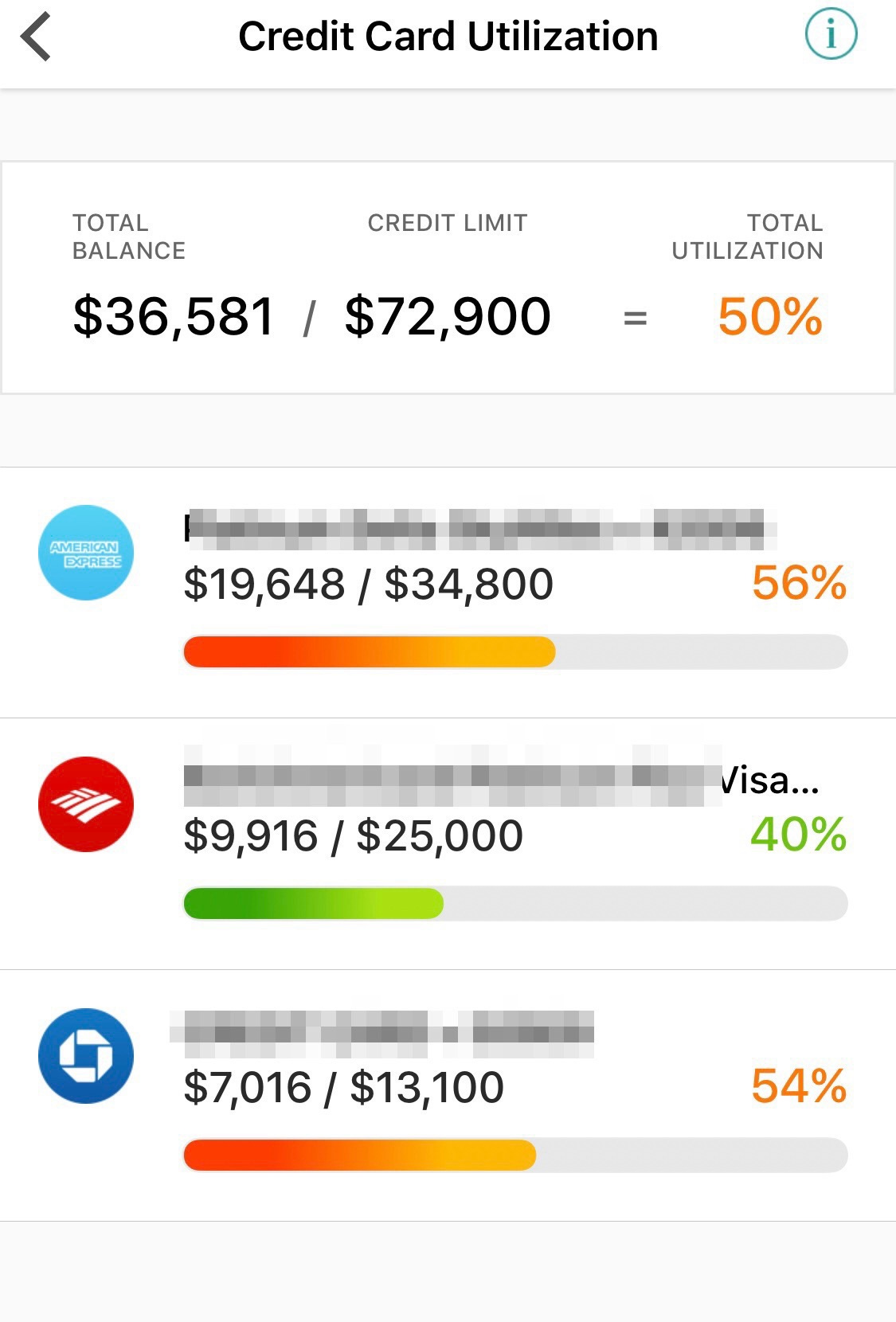

This is an actual photo of my previous credit card debt circa 2012.

Looking back, and adjusted for inflation, this is a shit-ton of money to be in debt for.

I was using 50% of available credit and this seriously and negatively impacted my credit score.

It weighed on me. It gave me crippling anxiety.

I never thought—after working in finance in the late aughts, and being somebody who had advised people on ways to improve their own personal credit when they were trying to buy homes—I would also find myself in a situation of less-than-perfect credit and carrying expensive credit card debt.

But there I was, with said expensive credit card debt.

I’ve written before about how I was unable to find stable work after the financial crisis, when I’d just moved back to New York from London.

I was in survival mode, and worked two retail jobs because it was all the work I could get at the time—despite my 2 master’s degrees and a career pivot.

In a way, I was lucky to lean on my credit cards to keep myself fed, and to avoid the slow hemorrhage of my 401(k) money, but I also had a lack of control and probably spent too much on going out, eating out, and other things I didn't need.

I was a little spoiled from having a fair amount of early success and perfect credit; I justified my spending by telling myself “I’ll pay it off eventually.”

Boy did I underestimate how hard and long I’d have to work to get there.

Some days, the figures would just glare at me and I’d really wonder what the hell I bought…meanwhile the debt was only compounding at high interest rates and fees.

I dug deep and practiced serious stoicism about not letting it get to me as I slowly tackled it.

Only after several years of working my ass off and allocating all of my extra money toward paying it off was I finally free.

So let this be a reminder: If you are tempted to spend, then here are some tips to avoid losing control.

These are the same ideas I gave to a room full of collegiate scholars when I spoke at a summer youth symposium—these young folks deserve to know all the things about money that school doesn’t teach.

Good and bad debt

Debt is expensive. Some kinds of debt are good, like a mortgage tied to a secured asset like a property, that slowly appreciates over time.

Other kinds of costly unsecured debt will hold you back from getting better financial deals, a good night’s sleep, and forward in life.

In my book, The Credit Cleanup Book (Bloomsbury 2014), and its sequel Credit Score Hacks (2016), I broke down how paying only the minimum amounts required on credit card bills can result in paying hundreds of times more than the original item’s cost — way more than its depreciated value and the impact of inflation.

6 ways to avoid impulsive spending

Opt for timeless value and quality

While this can apply to everything, this is key for people like me who used to spend recklessly on fashion. My advice here is buy the best quality of clothes you can afford and opt for versatile, timeless pieces you can mix and match, instead of trendy fast fashion.

Then, learn how to take care of your things to make them last longer. Wash clothes on delicate and hang them to dry, get your shoes re-heeled and soled, and invest in shoe trees so shoes retain their shape.Make it hard on yourself to buy things

Leave your credit cards at home and untether them from mobile wallet services that make it too easy to buy things, and, as mentioned above, avoid credit payment programs like Afterpay or Klarna because you will likely lose trackSay NO to retail and store loyalty cards

Instead, look for credit cards that offer cash back or points that can be redeemed for a better value on things like travelLearn how to beautify yourself at home

Manicures, pedicures, lash extensions, and other beauty treatments add up. Make time for self care and less-expensive pampering at home. It may take practice, but you’ll get there (and save time and money, too)Unsubscribe from consumer retail emails

If you don’t know about the sale, then did it ever happen? 😉Stick to a “Big Purchase” rule

Set a dollar figure, for example “anything over $100,” and wait 24 hours before you buy anything over $100. Easy.

If after 24 hours it’s no longer available, then it wasn’t meant to be. Only after the time has elapsed, and only if you can afford to pay it off in full on your next credit card bill, should you buy it. More often than not, you’ll just forget about it, and realize it wasn’t that serious to begin with.

What do you have your eye on this holiday shopping season?

What do you like to gift others: Gifts or experiences or other things?

How do you avoid spending temptation? I’d love to hear in the comments below!

P.S. How’s everyone feeling today? I hope you all had a wonderful Thanksgiving holiday, if you celebrated.

I have a lot to be grateful for, and I try not to lose sight of all my blessings.

I enjoy everyone gathering and feasting, but I also try to lead my days with an “attitude of gratitude.”

To me, giving thanks shouldn’t happen on just one day of the year.

The more I reflect on this, the more I can let troublesome and frustrating things sit, move on, and let go. At least that’s what’s helped me.

**

Until next time,

Shindy

On Instagram + TikTok

***

Did you enjoy this newsletter? Please ❤️

Click ❤️ at the top or bottom. This really helps me and this newsletter get shortlisted to Substack’s reader recommendations.

Know someone who needs to hear this? Sharing is caring

When you share my writing because you find value in it, that is the greatest gift. 🙏

A perfect reminder during the cyber selling season.

I always hang our clothes; they always look like new.

I’d have such anxiety if I had credit card debt. You’re so right about never using retail store cards.

Hope our pup bros can hang out very soon!

We all couldn’t believe how incredibly adorable they were when seeing one another again for the first time since they were eight weeks old. 💙💙💙💙