How to be good at money

My 5 key lessons to young people and the surprising questions they asked me

Can you feel it?

The “unofficial” end to summer is here, along with all the back to school energy that comes with it.

It’s an exciting time; I can feel the cooler air and nervous anticipation of a new school season; remember when you took advantage of these moments to molt into a new version of you?

Oh my god, so-and-so got hot over the summer!😏

All this back to school-ness reminds me of a recent talk I gave to 120 young scholars who, as I write this, are likely settling back into a new semester at college.

Content entrepreneur | Money expert | Agency Founder & CEO | Bestselling author featured in Forbes, The Wall Street Journal, Business Insider, Bankrate, Cheddar TV, and HuffPost | Join more than 5,460 people who follow my lifestyle, travel, money, and career advice:

I’ve written before about my mentorship for a young woman who also happens to attend my alma mater, the University of North Carolina at Chapel Hill.

It’s fun because I get to be vicariously nostalgic when she mentions old UNC haunts and experiences, like going to parties and football games.

I also get to watch as she pursues goals and hits milestones, like studying abroad and choosing her major.

My mentorship program, Greenhouse Scholars, which supports students from underrepresented groups, recently invited me to Boulder, Colorado, for their annual summer event to speak about financial responsibility.

The theme was “Grow Your Ability” and so my talk was called, “Grow Your Ability…to be Good at Money 🤑.” (emoji required, lol).

In my talk, I discussed 4 crucial topics: budgeting & spending, credit, and saving & investing.

I was intent on trying to share concepts and ideas I wish I’d learned about money at their age.

Here are the exact key points from my talk with the group:

1. Budgeting: Have enough for what you need

Needs vs. wants: “Wants” embellish “needs”

There are really only 3 things you need to survive in the modern world: Sustenance, shelter, and clothing.

Everything else is an embellishment.

For example, you need shoes, but you may want designer sneakers.

Knowing how to distinguish between needs vs. wants will help you budget for the most important things.

Inputs vs. outputs: Outputs are easier to control

(In the context of money) outputs are easier to control than inputs.

What do I mean by this?

It’s a lot easier to control what you spend (outputs) than how much you earn (inputs).

It’s darn near impossible to just snap a finger and magically double your salary, or if you're a business owner, double your sales.

More inputs require more time, effort, and strategy on your part.

So, it’s a lot easier to monitor your outgoings, and it’s a good sign if you’re aware of and keeping a reasonable eye on things.

Your income and earnings = What the market rewards you for your contributions

I’m not the first person to say this, but if you feel like you aren’t earning or being paid enough for your work, then step back and ask yourself why this is happening.

It’s perhaps more simple than you think: You haven’t convinced enough people, or the right people, to pay you for what you feel your contributions are worth in a general marketplace.

Ford sells a car at a price the market is willing to pay for it.

Ferrari also sells a car at a price the market willingly pays for it.

It’s all about convincing whoever’s paying, that your contributions are valuable and worth what you’re charging.

Use tools like apps or a simple Google Sheet

My savvy audience already knew about Mint and basic budgeting apps.

I support any tools that will help you get a handle on your budget.

Just remember, if such services are free, then it’s likely because you’re the product, i.e., your data (how you spend and what you’re spending money on) is valuable to their advertisers.

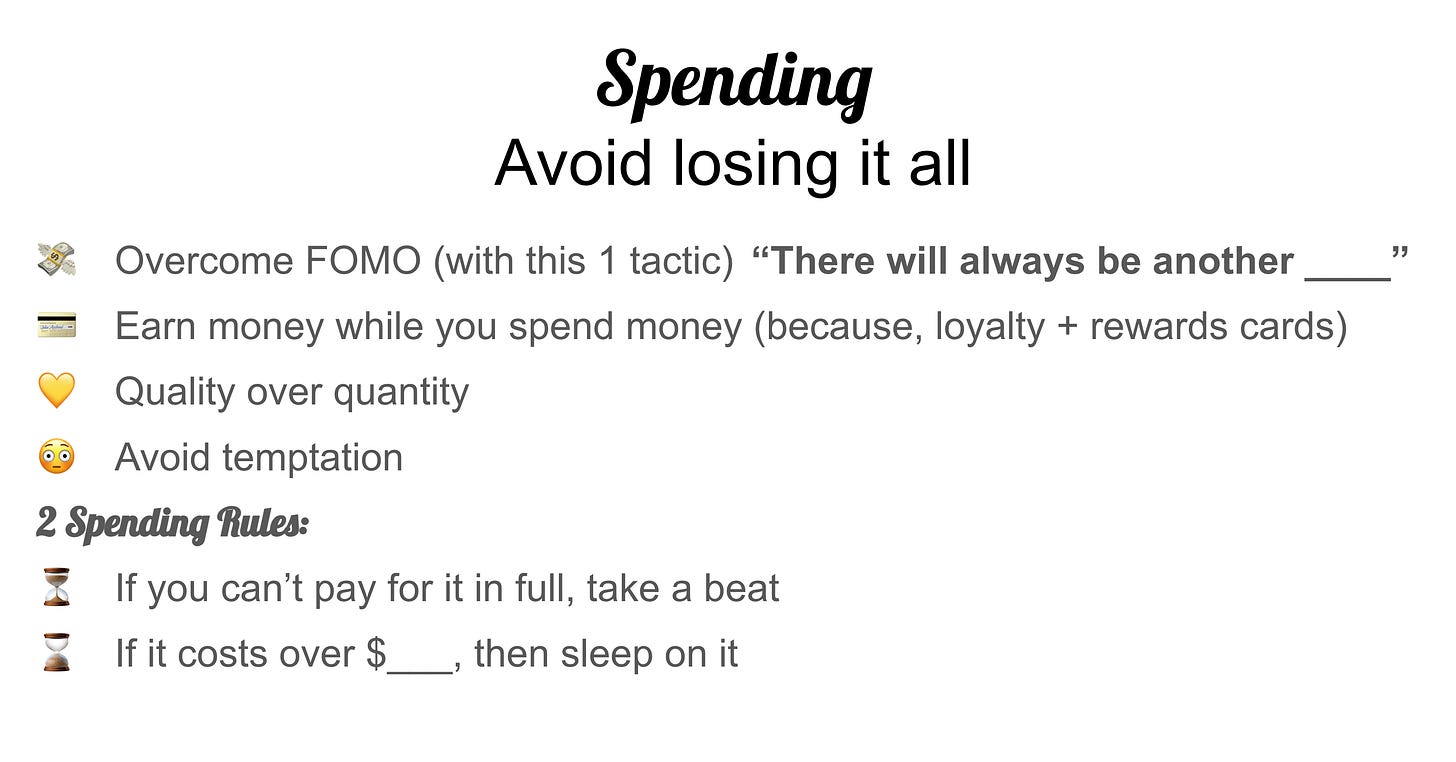

2. Spending: Avoid losing it all

Overcome FOMO (with this 1 tactic)

Fear of missing out, today’s parlance for "keeping up with the Joneses,” can drain on your wallet.

Use this mantra next time you feel compelled to do something or be somewhere:

“There will always be another ___.” For example [party/event/rave/Burning Man/conference/vacation].

Knowing and repeating this mantra will help you get over not feeling compelled to attend for whatever reason.

Earn money while you spend money (because, loyalty + rewards cards)

I wrote an entire newsletter on this subject here:

Quality over quantity

I generally believe in buying the best I can afford because it will last longer.

This applies to clothes, electronics, shoes—the whole gamut.

In general, if you also maintain and take care of said items, then they’ll last forever.

Avoid temptation

I’ve previously written about how I’m not buying any new clothes, and how I avoid spending temptation in general.

One simple thing I do is unsubscribe from promotional sales and emails because they will only facilitate buying in excess (remember, needs vs. wants).

2 important spending rules:

You can decide your personal money thresholds, and then apply the following rules:

If you can’t pay for it in full, take a beat

If it costs over $_, then sleep on it

3. Credit: Protect your greatest financial asset

As a 2x bestselling personal finance author on credit reporting and scoring, this topic is near and dear to my heart.

These simple rules will keep you on track for an excellent credit score:

Pay your bills on time

Don’t max out your credit cards

Think twice before opening any new credit cards

Consider freezing your credit

4. Saving: The first steps toward financial freedom

Saving is a muscle

After your bills are paid, put the rest away toward an emergency fund and reserves.

First, put money toward what I like to call an “Oh Shit!” fund.

That way, when shit literally hits the fan, you will have some money set aside to cover it.

In 2022, the Fed found that most Americans can’t produce $400 to cover emergencies.

Try to have at least that much, and then build toward it with 4 to 6 or even 6 to 8 months of living expenses (rent, mortgage, utilities, transportation, food) in reserves.

This will give you incredible peace of mind in case something happens.

“Set it and forget it” automated tools

If you don’t want to think about saving, then automate this task by transferring a fixed amount from a checking account into your savings or investments, at a frequency that works for you.

Find free, high APY checking and savings accounts

I like Marcus. Or Schwab. Or Ally. You can find them all online.

5. Investing: Keep and grow your hard-earned money

Of course, there are numerous products like ETFs and mutual funds that will help you dip your toe in the investing waters instead of jumping into the deep end.

Start slowly, decide your risk tolerance, add to it regularly, and sit back.

Don’t convince yourself that you can ever “beat” the market or be a successful overnight day trader just because you watched one YouTube video on stock or crypto trading.

Q&A

There was room for Q&A, and to say that I was impressed by the group’s questions is an understatement.

These young folks blew me away with what they already know about certain financial and investment products and tools, but also by how early they’re familiarizing themselves with financial markets.

A few questions stood out, ranging from the downright bold to those that mirror a combination of social media advice and basic financial education.

Q: What stocks do you hold?

I was happy to share what equities I hold and could actually remember on the spot: Tesla, Microsoft, Nintendo, Netflix, Snapchat (among others, but these were the ones I remembered off the top of my head).

Q. I’m holding NVDA right now but the stock price just took a hit. Should I sell?

What do you think I told this scholar?

If you act out of fear and do what everyone else does, you’ll be acting out of emotion and following the herd. NVDA is on an upward trend because of its affiliation to A.I., and it will likely continue trending upward.

If you act from a contrarian standpoint (i.e., buying when everyone else is selling) then over time you might find yourself on top.

Q. Should I start a Roth IRA?

I think Roths are a great product and offer wonderful flexibility, because you contribute what money you have (outside of your salary) and it grows tax-free until you take it out, presumably after you turn 59.5 years-old.

Obviously Roths work opposite of Traditional IRAs, and the big difference is whether you pay tax on your money now (Roth) vs. later (Traditional).

It’s a guessing game really, because no one knows what tax bracket they’ll be in after 59.5.

Maybe you’ll be richer or poorer (hopefully richer); my preference has always been to deal with the devil I know; tax certainty today, so if I’m not beholden to a Traditional IRA, then I would choose a Roth.

Q. What credit cards are best for me? How does a “cash back” credit card work?

This answer really lies in your spending behaviors. If you have high grocery bills, like to eat out a lot, and subscribe to online streaming services like Netflix, then get a credit card that rewards you for spending in those categories.

For example, cards like the Chase Sapphire credit card can offer triple points for online groceries, eating out, and streaming.

Cash back typically works as a portion of your monthly spend.

For example, if you charged $3,000, then your card provider might give you 1% back of that amount applied to your monthly statement, so $30.

Q. I’m ready to invest. How should I do it?

As mentioned, I would advise anyone starting out to just park your money in low-fee ETFs or brokerage services that offer low-fee index funds.

That way, you are exposed to fairly low risk and market volatility, and your money will grow and compound in interest.

I recommend roboadvisor services like Betterment, and or zero commission Schwab or Fidelity accounts so you can pick from a menu of low-cost investment products based on risk tolerance.

What money lessons do you wish you were taught about money, from a young age?

I’d love to hear about how this impacted your life, and how you learned or taught yourself. Just hit or comment below!

**

Until next time,

Shindy

On Instagram + TikTok

***

Like it

Did you enjoy this newsletter?

Please like it by clicking on the ❤️ at the very top or bottom of this post. This really helps get this newsletter recommended to SubStack’s recommended shortlists.

Referral Rewards

When you share my newsletter with someone you think would find value in it, that is the greatest gift. 🙏

ICYMI: Latest issues at shindy.substack.com:

A reminder that the above does not constitute “financial advice.” You should always do your own research so that you can make an informed decision based on what’s best for your personal financial circumstances, before you invest in any financial product.

FANTASTIC!!! I LOVED THIS!!!!! I learned tons and found this information to be fascinating, as always!!!!!