How to earn money as you spend money

If you're not rewarded for buying stuff, then what are you actually doing

Soon, I’ll be teaching a group of youngsters about money basics.

It’s not just any group—these are young scholars who attend some of the country’s most prestigious universities.

My short session will barely scratch the surface on budgeting, spending, credit, saving, and investing.

As I’ve been preparing my spiel, I think about all the things I didn’t know about money at their age.

I’ve written before about my mentorship efforts for young people.

This group comes from underrepresented groups and households, and some may even be the first in their family to attend college—you could say their families are betting on their future success.

Many are also the children of immigrants who work long, hard hours to ensure they’re able to pay college tuition(s).

I can relate; I grew up working in my parent’s Chinese restaurant.

I saw them put in the hard labor and long hours, but I also never saw them at most of my events like cheerleading at games or playing violin at symphony concerts and camps.

And before I got my drivers license, I had to rely on the kindness of friends’ parents for carpools and rides everywhere.

Looking back, it kinda sucked, but it also makes me appreciate everything I’ve worked hard to gain, and feel even more grateful I’ve been able to help my folks out when they’ve needed it.

My experience growing up shaped my money behaviors, until I became a fully functioning adult.

When I was starting out in my previous finance sales job, one of my first big commission months earned me an $18,000 paycheck.

I had no idea what to do with it except save it. Obviously today, there are so many ways to save and invest.

Content entrepreneur | Agency Founder & CEO | Bestselling author Featured in Forbes, The Wall Street Journal, Business Insider, Bankrate, Cheddar TV, and HuffPost | Join more than 3,700 people who follow my unconventional lifestyle, travel, money, and career advice:

I’ve immersed myself with different philosophies toward money, like being in control of it and not the other way around, which isn’t too dissimilar from working for yourself instead of being at the mercy of a salary.

My personal and professional circle helps; I try to surround myself with creative, big picture thinkers and entrepreneurs who are always hustling, growing, and openly discussing how they manage their businesses and personal wealth.

I’ve also seen firsthand the disparities between rich and poor—particularly the important conversations and lessons that wealthy families discuss and pass on, that lower to middle class families avoid or don’t.

This is exactly why I don’t tend to take unsolicited (money) advice from people who aren’t operating at a similar or higher level than me, including my parents.

They were so busy trying to operate our family business, they simply didn't have time to teach me any core lessons about money.

Nothing beyond the back-and-forth basics of what I saw for myself: struggle/save, pay bills/save, scarcity/save, fear of spending/save.

No offense to them, but I’m no longer fearful of spending money, because I’ve gotten smarter about how to make each purchase work for me.

Like Ramit Sethi says, if something makes you happy, like spending $20 on a smoothie or business class on long-haul flights, then work hard to make it happen and save and invest the rest.

Today, there are ways to earn something every time you spend money.

How to make your spending work for you

Here’s how: rewards credit cards.

It starts with having decent enough credit so that you can qualify for said cards.

I’m still a believer that your personal credit is your greatest financial asset.

You can leverage it in so many ways, including using it to build and reinvest in businesses, including real estate.

I’ll be sure to drive this point home to the young crowd I’m speaking to.

My card of preference: the Chase Sapphire card.

Don’t have one? Let me know with a reply, and I’ll send you a link to get you even more bonus points when you sign up.

Both the Reserve or Preferred cards are great, and you can earn points for every dollar you spend.

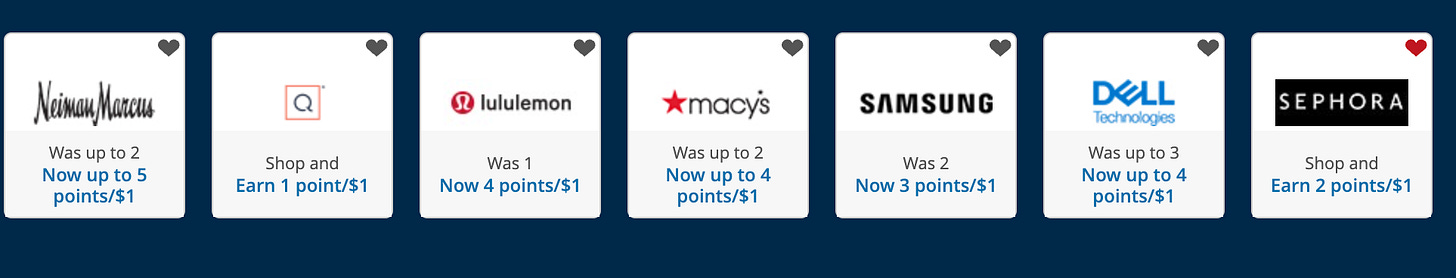

But here’s the best part: some of your favorite brands may already be rewarding you double or even 4x the points to the dollar; that’s pretty sweet for if you’re already a fan and their buying stuff anyway.

The only catch is that you must first visit the Chase Ultimate Rewards portal and shop from a link; you won’t earn the additional points if you go directly to a retailer, say, sephora.com.

I get that it might be a hassle; but the rest is easy and no different than if you had visited the site directly by yourself.

It’s a one-minute minor inconvenience that’s worth it.

I’ve discovered some brands are offering double to quadruple or more points with Chase Sapphire (at time of writing):

Gucci: (I once got) 4x points on a pair of shoes

ALO Moves: You can get 8 points per $1 for monthly subscriptions $13/monthly or 104 points

Online grocers: Doordash and Instacart offer 3x points

Home Depot: 6x points

Lyft: 5x points

Eating out: 3x points

When you’re ready to redeem your points, you can do so on the Chase Ultimate Rewards travel portal, which offers the biggest redemption payoff at ~$1.30 per dollar. Even so, using Chase Travel to book travel will yield 5x points.

You can also redeem points for cash back to your credit card statements, but the best redemption value hands down is for travel.

What not to buy with Chase Sapphire

Because Chase Sapphire allows you to redeem Ultimate Rewards points for Amazon purchases, you won’t earn points on Amazon with your Sapphire card. Bummer.

In such cases, I use another loyalty points card like a Delta Reserve American Express card to earn points.

Those MQMs stack up to get medallion qualifications year over year, so you can still earn something when spending.

What about you? Do you track your spending at all?

Any favorite tips you might wish to share by replying or commenting below?

**

Until next time,

Shindy

On Instagram + TikTok

***

Like it

Did you enjoy this newsletter?

Please like it by clicking on the ❤️ at the very top or bottom of this post. This really helps get this newsletter recommended to SubStack’s recommended shortlists.

Referral Rewards

When you share my newsletter with someone you think would find value in it, that is the greatest gift. 🙏