How I started my crypto portfolio with $100

It’s not too late if you think the risk is worth the reward + how to get started

PSA: Would you like to sponsor my weekly letters? If so, reply to this letter or get in touch: hello@shindychen.com.

I bought my first tiny share of Bitcoin (BTC) back in May 2018 with $100, when one bitcoin was just $8,598.50.

I bought it again two months later when BTC was $8,241.

Over the years, I’ve bought way more, sold some, and will likely continue with this strategy for years ahead.

Content entrepreneur | Agency Founder & CEO | Bestselling author Featured in Forbes, The Wall Street Journal, Business Insider, Bankrate, Cheddar TV, and HuffPost | Join more than 6,480 people on the internet who follow me for discerning lifestyle, travel, and money content:

Of course, recent headlines are screaming that BTC has reached an all time high this week of +$112,000.

The pundits and news media are always quick to yell about extreme highs and lows, because the drama is exciting; forget the deep dives into volatility or about holding assets for long term value, because that’s boring.

(The same is true when the media idolize CEOs at the top of their game, but then relish their downfalls, too. Nevermind the in-between stories, because drama is what gets the clicks and subs.)

If you’re already on the crypto bandwagon, then wooo, lookit you!

But if you’re not (yet) and have FOMO, or think it’s too late to get involved, then I have two thoughts for you: please don’t (have FOMO), and no it’s not (too late).

Two tenets of crypto investing

My two tenets of crypto investing are simple:

Don’t be stupid

Have fun

Regardless of how you feel about crypto—I’m not going to romanticize or philosophize about it—I believe it to be a unique, autonomous form of currency that’s worth investing in, and an opportunity for real long-term wealth accumulation.

You may wish to not touch it with a 10-foot pole. And that’s okay!

Once I feel like I’m being unreasonable, a little crazy, or a little stressy about it, then I know I should log out of whatever platform I’m in and go outside among human beings and/or touch real grass.

Of my entire financial portfolio, my crypto holdings represent just a little, not a lot, of the sum total.

I’d say crypto currently makes up about 10% of my net worth, and I’d like to keep it under 20%.

Those are my personal preferences, of course, and everyone has different investment goals, timelines, and risk thresholds, and only you can figure out what works best for you.

How to get started investing with crypto

Today, platforms like Coinbase, Robinhood, and Kraken make it super easy to buy crypto.

You simply create an account, link a funding source (most likely your bank checking account), transfer in $US dollars (USD 0.00%↑), and then buy the amount of crypto you want; the platforms handle the conversions.

There’s a whole other world of ‘decentralized’ platforms too, where transactions don’t touch your average regulated banks and financial institutions, but that’s another space entirely and one we won’t get into; it often requires logging in with VPNs and added layers of security, complexity, and sometimes, tech savvy.

Like any trading platform, mind the fees.

If you’re trading a lot and/or at a high volume, then Coinbase has a subscription program called Coinbase One, where you can save on fees-per-trade.

But you really shouldn't be investigating that tier unless you are a fairly seasoned crypto trader, with a lot at stake and you may even have a combo of cold and hot wallets where you’re keeping your crypto.

Do your own research

Which brings me to my next point: Please do your own research (DYOR); a common phrase in crypto land.

There is absolutely no reason to get into weird pump-and-dump schemes or buy any coins recommended by crypto communities or influencers.

That doesn't mean you shouldn’t, but doing so is entirely speculative and at your own risk.

It’s more important than ever to have your guards up against herd mentality.

Many times token endorsements are made by people who have been promised early access or shares in exchange for promotion; when people buy-in, the coin’s price “pumps” and people (especially the earliest endorsers) might make money at first, while everyone else loses it all if they don’t sell before it’s “dumped.”

In many ways, crypto investing isn’t too dissimilar from regular stock trading; you can also create limit orders to sell (when the token price hits a high or low) then you can attempt to protect your gains and losses.

But, limit orders are a huge differentiator between novice and experienced traders and require a bit more sophistication in hypothesizing about what price you’d want to buy more of the same thing, or at what price you want to sell and cut your losses.

Stick with the basics

The tried and true cryptocurrencies are Bitcoin and Ethereum.

You can start with those as they are the most “legitimate” of the currencies; even leading financial institutions now offer ETFs or funds that invest in and track their performance.

You’ll probably lose money

I’ve been part of a community where a list of tokens was recommended, and I bought in.

Only to find, a year later, one of the tokens (FYN) was delisted by the exchange where it was being traded and held.

Luckily I didn’t lose a lot (<$100). Oh well, lesson learned!

But you may make money, too

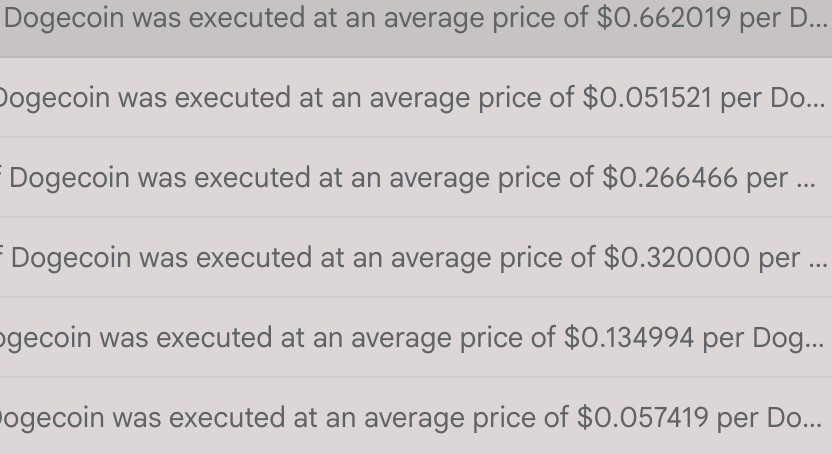

I was also among the many who invested in DOGE back in February 2021.

When I sold most of my lot in May 2021 I earned a healthy return. A reminder that any money converted and realized from crypto will be subject to income taxes.

More from the Shindy-verse

📺 Shows I’m watching

The Gilded Age (on

MaxHBO) - continuing thisStill watching the forever trainwreck of And Just Like That… on

MaxHBOSquid Game, Netflix - 1 ep. left to go! Gory! Riveting!

Grown Ups and Grown Ups 2 are on Netflix. I spotted a young Patrick Szwarnegger (White Lotus) among one of Tayor Lautner’s frat boys

📚 I’m reading…

This article by Candace Bushnell in The Cut says everything about her skills as a writer and why only she could have created Carrie Bradshaw and Sex and the City.

What about you?

Are you anti-crypto? Or a proponent/investor?

I’d love to know why!

Reply or comment below!

**

Until next time,

Shindy

On Instagram + TikTok

***

Like it

Did you enjoy this newsletter?

Please like it by clicking on the ❤️ at the very top or bottom of this post. This really helps get this newsletter recommended to Substack’s recommended shortlists.

Or, if you enjoyed this, learned something new, and it will help you in any way, then you can also show your appreciation by buying me a coffee:

Share it, tell someone else about it

When you share my newsletter with someone or another big audience, that is the greatest gift.

This letter is free to all subscribers

My Substack is free for all subscribers. But paid subscriptions at $5 monthly and $4 per month charged annually are so, so appreciated. You can manage or upgrade your subscription here:

**

Until next time,

Shindy

On Instagram + TikTok

***

Like it

Did you enjoy this newsletter?

Please like it by clicking on the ❤️ at the very top or bottom of this post. This really helps get this newsletter recommended to Substack’s recommended shortlists.

Or, if you enjoyed this, learned something new, and it will help you in any way, then you can also show your appreciation by buying me a coffee:

Share it, tell someone else about it

When you share my newsletter with someone or another big audience, that is the greatest gift.

This letter is free to all subscribers

My Substack is free for all subscribers. But paid subscriptions at $5 monthly and $4 per month charged annually are so, so appreciated. You can manage or upgrade your subscription here:

Learned a lot!!! Love DYOR!